Taxpartner

ACCOUNTANT

21 Dennyview Road, Abbots Leigh, BS8 3RD, Bristol

About Us

Taxpartner was established in 2002 to provide expert Corporate, VAT, Personal and Employment tax advice to a broad range of private and public companies. taxpartner managers have extensive experience within the UK's 'Big 4' accountancy firms, advising on both UK and International related issues.Services

Group and company tax accounting under both UK and International Standards Company tax return preparation Handling HMRC Enquiries Quarterly instalment payment calculation Effective tax rate forecasting and tax policy Capital allowance reviews R&D and Patent Box claims Private equity related tax issues including interest deductibility and VAT recovery Restructuring advice Tax due diligence Senior Accounting Officer advice Providing tax department resource iXBRL tagging of company accounts VAT consultancy PAYE/NIC mitigation Salary sacrifice Employment status PAYE settlements Expense policies Redundancies and relocations Termination payments Share scheme reporting

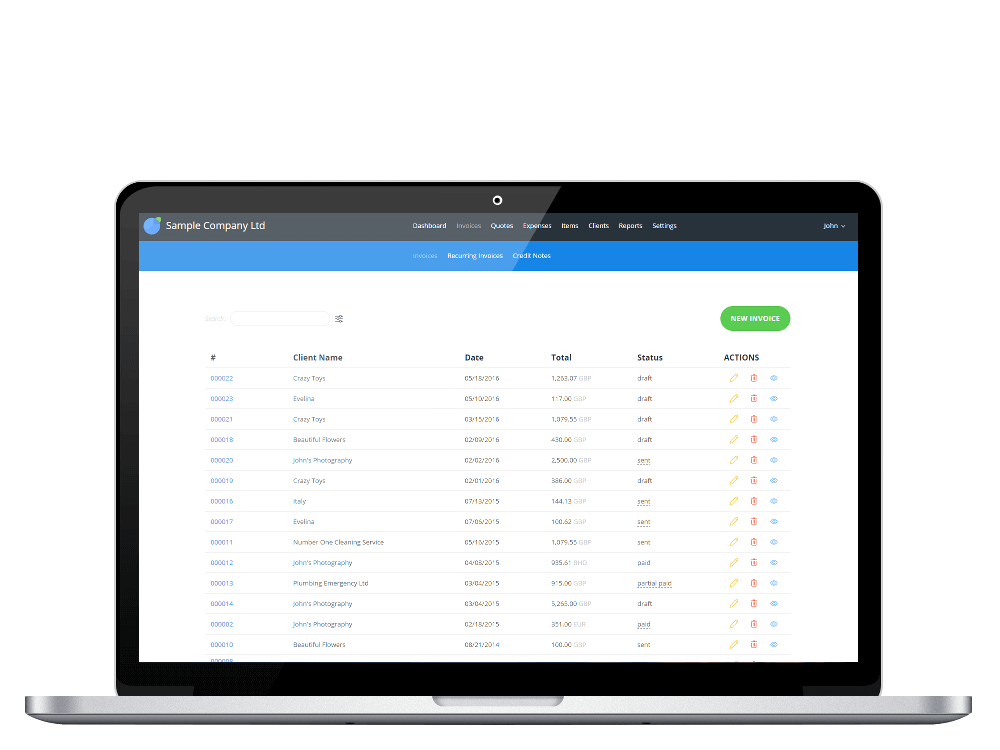

Need help with your invoicing?

InvoiceBerry simplifies invoices and expense tracking, helping you save time and money. Create your first invoice in the next 5 minutes.

InvoiceBerry simplifies invoices and expense tracking, helping you save time and money. Create your first invoice in the next 5 minutes.